Measuring the Success of Circular Fashion Models

Profitability Metrics: Key Indicators

Profitability is a cornerstone of economic viability, measuring the success of a business in generating revenue above its costs. Key profitability metrics include gross profit margin, operating profit margin, and net profit margin. Each metric provides a different lens through which to view the financial health of an organization. Understanding these figures allows for strategic decision-making regarding pricing, cost optimization, and overall operational efficiency. Analyzing trends in these metrics over time is crucial for identifying patterns and making informed projections about future performance.

A high gross profit margin indicates strong pricing power and effective cost control at the initial stages of production. An increase in the operating profit margin suggests improved management of operational expenses. Finally, the net profit margin reflects the overall profitability after considering all expenses, including taxes and interest, and is a critical indicator of a company's ability to generate returns for its investors.

Resource Efficiency: Optimizing Inputs

Resource efficiency is a crucial aspect of economic viability. It involves minimizing the consumption of resources like raw materials, energy, and labor while maximizing output. This approach not only reduces costs but also contributes to sustainability by minimizing environmental impact. Companies that excel at resource efficiency can achieve significant cost savings and improve their long-term competitiveness.

Quantifying resource efficiency often involves calculating metrics such as material usage per unit of output or energy consumption per unit of production. Analyzing these metrics helps identify areas for improvement and implement strategies for optimization. This could involve investing in new technologies, improving processes, or adopting more sustainable practices.

Capital Expenditure and Return on Investment (ROI)

Capital expenditure (CapEx) plays a vital role in evaluating economic viability. It represents the investment made in fixed assets like property, plant, and equipment. Understanding the return on investment (ROI) from these expenditures is essential for determining the long-term financial health and growth potential of a business. A high ROI indicates that investments are generating significant returns and contribute positively to profitability.

Calculating ROI involves considering the initial investment, the projected returns, and the time frame over which these returns are expected. This calculation helps businesses prioritize investments and allocate resources effectively.

Revenue Growth and Market Share Analysis

Consistent revenue growth is a key indicator of a company's success and economic viability. Analyzing revenue trends over time provides insights into the company's performance and market position. A steady increase in revenue suggests a growing market share and potentially higher profitability in the future.

Market share analysis is essential in understanding the company's position within the industry. A growing market share indicates strong competitive advantages and a potential for further expansion. Tracking market share provides a crucial understanding of the competitive landscape and allows for informed strategic planning.

Cost Structure and Management

A detailed analysis of the cost structure is critical for evaluating economic viability. Identifying fixed costs, variable costs, and overhead expenses helps in understanding the overall cost dynamics of the business. Effective cost management strategies can significantly impact profitability and resource efficiency, leading to a more sustainable and financially sound operation.

Strategies for cost management include optimizing procurement processes, implementing lean manufacturing principles, and exploring opportunities to reduce waste.

Financial Ratios and Benchmarks

Financial ratios provide valuable insights into a company's financial health and economic viability. These ratios, calculated using data from financial statements, offer relative comparisons between different aspects of the business, such as liquidity, solvency, and profitability. Comparing these ratios against industry benchmarks allows for a more nuanced understanding of a company's performance and identifies areas for improvement.

Key financial ratios include current ratio, debt-to-equity ratio, and return on assets. Analyzing these ratios and comparing them to industry averages provides a comprehensive picture of the company's economic strength and its competitive position.

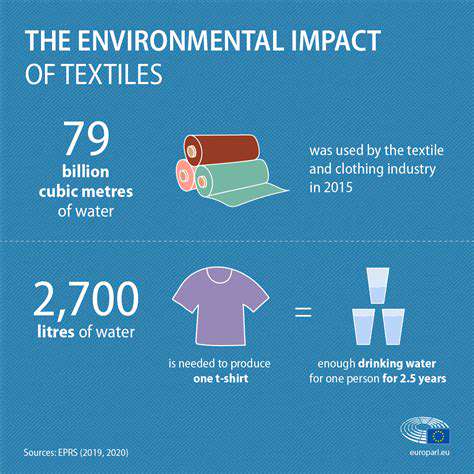

Sustainability and Environmental Impact

In today's globalized world, environmental considerations are increasingly intertwined with economic viability. Companies must consider their environmental impact in evaluating their long-term sustainability and profitability. Measuring and reducing their environmental footprint can attract environmentally conscious consumers and investors and minimize regulatory risks.

Sustainability strategies may include reducing energy consumption, minimizing waste, and adopting eco-friendly practices throughout the value chain. Companies that integrate sustainability into their core operations can gain a competitive advantage and enhance their long-term economic viability.

Environmental Impact Assessment: Reducing Textile Waste and Pollution

Environmental Considerations

Environmental Impact Assessments (EIAs) are crucial for evaluating the potential consequences of proposed projects on the environment. A thorough EIA considers a wide range of factors, including air and water quality, biodiversity, and potential impacts on ecosystems. Understanding these potential impacts is vital for informed decision-making and mitigating negative consequences. This process often involves extensive research and data collection to assess the project's potential effects.

Careful consideration of the environment is paramount in project planning. Failing to account for environmental factors can lead to irreversible damage to ecosystems and biodiversity, impacting human well-being as well. This necessitates the use of various methodologies to accurately predict and assess the project's environmental footprint.

Assessing Potential Impacts

An EIA meticulously analyzes potential impacts on various environmental components. This includes evaluating the effects on air and water quality, which can be affected by emissions and effluent discharge. The assessment also explores potential disruptions to ecological systems, considering habitat loss, fragmentation, and species displacement. The long-term effects on biodiversity and the overall health of the environment are meticulously documented.

Evaluating potential impacts requires expertise in various scientific disciplines. Environmental scientists, biologists, and other specialists are often involved in the process, employing a range of data collection and modeling techniques. This multidisciplinary approach ensures a comprehensive understanding of the project's potential consequences, allowing for the identification of mitigation strategies.

Mitigation Strategies

An effective EIA should not just identify potential problems but also propose practical mitigation strategies. These strategies aim to minimize negative impacts and enhance positive outcomes. For example, measures to reduce emissions, control waste disposal, and protect endangered species are crucial components of an effective EIA. The implementation of these strategies is essential for ensuring that the project's environmental footprint is minimized.

Careful planning and proactive measures are paramount to avoiding environmental harm. Mitigation strategies often involve the development of alternative designs, the implementation of pollution control technologies, and the establishment of protected areas. These strategies can significantly reduce the negative consequences of the project and safeguard the environment.

Conclusion

In conclusion, environmental impact assessments provide a critical framework for evaluating the potential environmental consequences of projects. By considering the potential impacts on air and water quality, biodiversity, and ecosystems, EIAs enable informed decision-making and the development of effective mitigation strategies. The comprehensive approach employed in these assessments is crucial for sustainable development.

The concept of ownership in the metaverse is a complex and evolving one, challenging traditional understandings of property rights. Digital assets, from virtual land parcels to avatars and in-game items, present unique challenges for establishing clear ownership. Decentralized technologies like blockchain are often employed to create verifiable records of ownership, but even these systems are not without vulnerabilities and require careful consideration regarding their implementation and governance within the metaverse.