The Art of Mindful Shopping: A Guide to Intentional Purchases: New Practices

Understanding the Difference

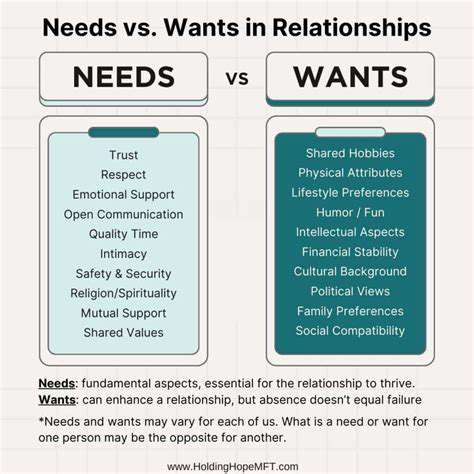

Mastering the distinction between needs and wants transforms how we make decisions every day. Needs form the bedrock of our existence—things like nutritious meals, safe housing, and weather-appropriate clothing. These aren't just preferences; they're the building blocks that keep us healthy, both physically and mentally. When we neglect these fundamentals, we risk serious consequences that can ripple through every aspect of our lives. Recognizing this critical difference helps us allocate our time, money, and energy with greater wisdom.

Wants, by contrast, represent our aspirations for enhanced comfort and personal expression. That artisanal coffee blend, those designer shoes, or the latest tech gadget—while they might bring joy, they won't determine our survival. What's fascinating is how fluid our wants can be, shifting with trends, life stages, and personal growth, unlike our more constant needs.

Prioritizing Needs

Putting needs first isn't just practical—it's transformative for both personal stability and financial health. When we secure life's essentials, we create a platform for pursuing larger ambitions without the distraction of unmet basics. This grounded approach means we operate from abundance rather than scrambling to fill fundamental gaps.

Clarity about needs revolutionizes how we manage money. By methodically addressing necessities first, we create breathing room to thoughtfully consider discretionary spending. This structured approach builds resilience, ensuring we're prepared for life's uncertainties while still enjoying its pleasures.

Recognizing Wants

Our wants tell the story of who we aspire to be. While not essential for survival, they add texture and satisfaction to our daily experiences. That concert ticket, the vintage book collection, or the weekend getaway—these are the flavors that make life uniquely ours.

Understanding our desires empowers smarter choices about where to invest our resources. Some wants align closely with our deepest values, while others might be passing fancies. The art lies in discerning which desires truly resonate with our authentic selves and which are merely momentary impulses.

Managing Your Resources Effectively

The magic happens when we balance needs and wants with intention. A thoughtful budget serves as both compass and safeguard, ensuring essentials are covered while leaving space for meaningful indulgences. This includes planning for tomorrow—setting aside funds for emergencies and future goals while enjoying today.

This balancing act requires honest reflection and sometimes difficult choices. Do those premium groceries enhance your wellbeing enough to justify the cost? Is that subscription service adding value commensurate with its price? These daily decisions, made consciously, compound into significant financial and personal benefits over time.

Developing a Shopping Strategy: Setting Limits and Creating a Budget

Defining Your Needs and Wants

Before opening your wallet, pause to consider what you're really buying. True needs sustain your life's basic functions—nourishment, protection, and essential tools for work or education. Wants, while enjoyable, are the optional upgrades that make life more pleasant. This discernment becomes your financial compass, helping navigate between necessity and desire with clearer vision.

When we examine each potential purchase through this lens, we short-circuit impulsive buying. That moment of reflection—Do I need this, or do I want it?—can save hundreds of dollars annually while keeping spending aligned with personal priorities.

Establishing a Realistic Budget

Crafting a budget isn't about restriction—it's about empowerment. By documenting income streams and tracking where dollars actually go, patterns emerge. Maybe those daily coffee runs add up to a car payment, or perhaps subscription services quietly drain funds that could accelerate debt repayment.

The most effective budgets anticipate life's unpredictability. They include cushions for unexpected repairs or medical bills while systematically building reserves for future goals. This forward-thinking approach transforms budgets from constraints into tools for financial freedom.

Setting Purchase Limits

Financial boundaries create freedom. By predetermining spending ceilings for categories like groceries, entertainment, or clothing, we make dozens of small decisions in one thoughtful moment. These limits aren't arbitrary—they flow naturally from understanding your income, fixed expenses, and savings targets.

Consider implementing cooling-off periods for major purchases. Waiting 48 hours before buying anything over a set amount often reveals whether the desire persists beyond initial excitement. Many find this simple practice dramatically reduces regret spending.

Prioritizing Essential Purchases

Shelter, utilities, nutritious food—these form the non-negotiables that keep life running smoothly. Addressing them first creates psychological and financial stability. There's profound peace in knowing the lights will stay on and the pantry remains stocked, even if it means postponing that new outfit or upgraded gadget.

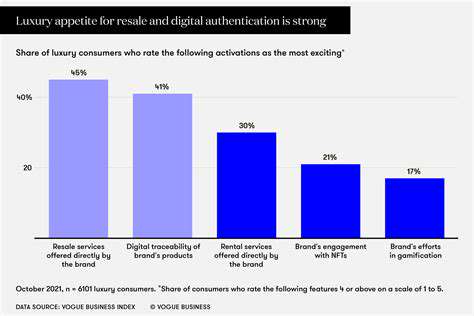

Exploring Alternative Shopping Strategies

Thrift stores, buy-nothing groups, and repair cafes aren't just budget-friendly—they're often more sustainable and community-oriented. That barely-used designer blazer at the consignment shop carries both financial and environmental savings. Learning basic mending skills can extend clothing life by years, creating both economic and ecological benefits.

Discount hunting becomes a game when approached creatively. Stacking manufacturer coupons with store promotions during seasonal sales can yield surprising savings. Many discover these alternative approaches spark more satisfaction than conventional shopping ever did.

Utilizing Comparison Shopping Tools

Technology puts unprecedented price transparency at our fingertips. Browser extensions that track price histories reveal optimal buying times, while aggregated reviews help avoid disappointing purchases. For big-ticket items, some stores offer price matching—always worth inquiring.

Remember that the cheapest option isn't always the most economical. Sometimes paying slightly more for better quality saves money long-term by reducing replacement needs. Comparison tools help evaluate this total cost of ownership.

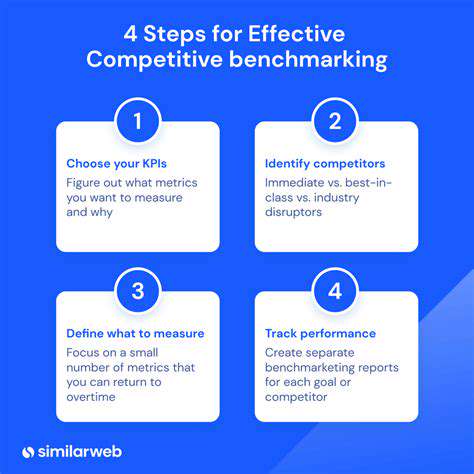

Reviewing and Adjusting Your Strategy

Financial plans shouldn't be set in stone. Life brings raises, new expenses, shifting priorities. Quarterly check-ins allow course corrections before small drifts become major detours. Maybe that gym membership went unused all winter, or perhaps growing freelance income allows increasing retirement contributions.

These regular reviews become celebrations of progress—noticing how small, consistent choices accumulate into meaningful financial growth over time. They're also opportunities to acknowledge changing values and adjust spending accordingly.