The Circular Economy of Designer Fashion Resale: New Markets

Innovative designers are taking this further, transforming damaged luxury items into entirely new creations. A stained silk scarf becomes an embellishment on a denim jacket. Worn leather gloves get repurposed as accent details on handbags. This creative upcycling proves that sustainability and high fashion aren't mutually exclusive.

The Role of Technology in Resale

The smartphone in your pocket has become a portal to the world's finest closets. Apps now offer augmented reality try-ons, AI-powered price suggestions, and blockchain authentication certificates. Technology hasn't just improved resale—it's made authenticity verification as rigorous as museum curation. High-resolution zoom reveals stitching patterns, while serial number databases track an item's provenance back to its original boutique.

These digital platforms have also created micro-economies. Stay-at-home parents monetize their fashion expertise by becoming resale consultants. College students fund tuition by flipping vintage finds. The resale revolution isn't just changing what we wear—it's creating new ways to earn.

The Impact on the Fashion Industry

Luxury brands are taking notice. Some now offer buy-back programs, while others design with resale in mind—using more durable materials and timeless silhouettes. The resale market's growth has forced luxury houses to confront their environmental impact head-on. This pressure is yielding tangible results: Gucci now tracks the carbon footprint of each handbag, while Stella McCartney's designs consider disassembly for future recycling.

Perhaps most remarkably, resale is shifting the very definition of luxury. No longer just about exclusivity, true luxury now encompasses craftsmanship that stands the test of time. The most coveted items aren't necessarily the newest—they're the ones with stories to tell and decades of life left in them.

Beyond Thrift Stores: Specialized Resale Platforms

Designer Resale Platforms: A New Frontier

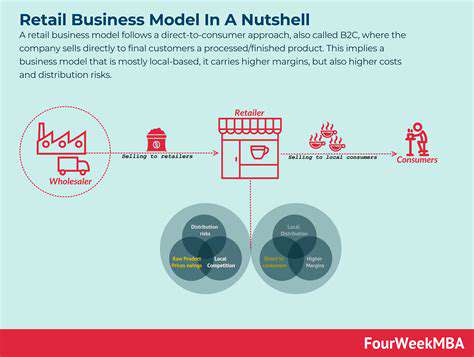

Forget musty thrift stores—today's luxury resale happens in digital boutiques with white-glove service. Platforms like The RealReal employ former luxury retail experts who authenticate items with the scrutiny of art appraisers. Each listing includes detailed condition reports that would put most auction houses to shame: Minor scuff on left heel, barely visible or Original dust bag included.

The experience rivals traditional luxury shopping. Some platforms offer personal stylists who'll assemble complete looks from pre-owned pieces. Others provide historical pricing data so buyers can invest wisely. It's a far cry from digging through racks at the local charity shop.

Bridging the Gap Between Luxury and Sustainability

These platforms solve fashion's dirty secret: even eco-conscious consumers struggle to resist beautiful things. Now they can indulge guilt-free—a pre-owned Prada bag saves the CO2 equivalent of 60 plastic bottles. The math is compelling: buying one used item reduces its carbon footprint by 82% compared to buying new.

Forward-thinking brands are embracing this. Burberry now partners with resale platforms, while brands like Eileen Fisher operate their own recommerce sites. It's a smart play—these platforms become brand ambassadors, introducing luxury to younger consumers who might later buy new at full price.

The Economic and Social Impact

The resale economy is creating opportunities where traditional retail struggles. Small towns now have closet entrepreneurs—people making six figures selling designer finds online. The platforms themselves employ thousands in authentication centers, photography studios, and customer service roles that can't be outsourced.

Socially, this movement is redefining value. A teenager's first designer purchase might be a pre-loved item rather than a fast-fashion knockoff. That changes their relationship with quality and consumption from the start. The luxury resale market isn't just surviving—it's thriving by making sustainability aspirational.

New Market Segments and Shifting Consumer Preferences

New Market Segments Emerging

The resale revolution has birthed entirely new consumer profiles. Meet the Re-Luxury shoppers—affluent buyers who prefer pre-owned for ethical reasons, not financial ones. Then there are Circular Fashionistas, building entire wardrobes from resale platforms. Even corporations are getting in, with some startups offering luxury rental subscriptions for business wardrobes.

Demographics tell an interesting story. While millennials dominate resale, Gen Z is the fastest-growing segment—with 40% having bought secondhand luxury in the past year. Their purchasing patterns suggest this isn't a phase, but a fundamental shift in how younger consumers view ownership.

Shifting Consumer Preferences

Status symbols have flipped. Where logos once screamed new money, today's flex might be a perfectly patinaed vintage Rolex. The new luxury consumer values provenance over packaging—they want to know which Parisian boutique a handbag came from, not just its current season status.

This extends to brand perceptions. Labels with strong heritage and craftsmanship do best in resale, while trend-driven brands struggle. Consumers increasingly see resale value as a key purchase consideration—if it won't hold value, is it really luxury?

Technological Advancements and Market Impacts

AR and AI are removing the last barriers to online resale. Virtual try-ons now simulate how a jacket drapes on your specific body shape. Machine learning predicts which items will appreciate, creating a new category of fashion investment. Some platforms even use computer vision to spot fakes by analyzing stitching patterns invisible to the human eye.

The data generated is invaluable. Resale platforms know which colors retain value, which styles have longevity, and how different demographics shop. This intelligence is starting to influence new designs—some brands now create pieces specifically for strong secondary market performance.

Sustainable Practices and Societal Values

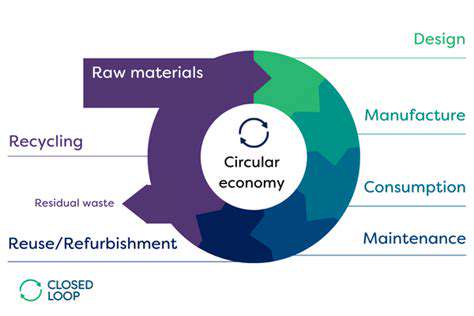

Resale has become the gateway drug to sustainable fashion. Once consumers experience quality craftsmanship through resale, fast fashion often loses its appeal. This creates a virtuous cycle—better-made items enter the resale stream, reinforcing the value of durability.

The societal impact extends beyond fashion. As resale normalizes circular consumption, it's influencing other sectors. Consumers now expect similar models for electronics, furniture, even cars. The luxury resale movement may ultimately reshape our entire relationship with material goods.

The Future of Luxury: A Sustainable and Circular Approach

Designing for Multiple Lifetimes

Forward-thinking brands are engineering products with disassembly in mind. Imagine a handbag where the leather can be replaced while the hardware gets reused, or a coat designed for easy tailoring as styles change. This design for disassembly philosophy represents the next frontier in circular luxury.

Some innovators are taking this further. Piñatex makes leather alternatives from pineapple leaves, while Bolt Threads grows silk proteins in labs. These materials aren't just sustainable—they're often superior to traditional options, challenging the very definition of luxury materials.

The Rise of the Hybrid Consumer

The line between new and pre-owned is blurring. Tomorrow's luxury customer might buy a new winter coat but pair it with vintage accessories, creating a sustainable but still luxurious aesthetic. Brands that embrace this hybrid approach—offering both new items and certified pre-owned—will thrive.

Luxury services are adapting too. High-end consignment is becoming a standard service at boutique hotels—drop off last season's pieces and pick up new-to-you finds before checkout. Department stores are adding resale sections alongside new collections. The future isn't new versus used—it's a curated mix of both.

Circular Systems at Scale

Industry-wide systems are emerging to support circularity. A global network of refurbishment centers could give luxury items professional spa treatments between owners. Digital product passports—blockchain records of an item's entire lifecycle—will become standard, ensuring authenticity and enabling better recycling.

The ultimate goal? A true closed-loop system where luxury items circulate indefinitely, with brands responsible for their products through every stage of life. In this future, the most prestigious label might not be a logo, but a certification of circular integrity.

Education as the Ultimate Luxury

The next status symbol? Knowledge. Luxury brands will distinguish themselves by educating consumers about materials, craftsmanship, and care—transforming buyers into stewards of their possessions. Masterclasses on leather care, textile conservation, and repair techniques will become coveted perks.

This education extends to retail staff. The sales associates of tomorrow will need to explain a garment's entire lifecycle—not just its current season appeal. In the circular luxury future, the most valuable currency isn't money—it's understanding how to make beautiful things last.