From Value Chain to Value Loop: The Circular Advantage

Reimagining Business Models for a Sustainable Future

Decoupling Growth from Environmental Impact

The shift toward sustainable business models is now imperative, not optional. The outdated linear approach—take, make, dispose—has proven disastrous for our planet. Forward-thinking companies are actively severing the link between profitability and ecological harm. This demands radical changes in resource management, waste reduction, and circular economy adoption. Prioritizing energy efficiency, slashing emissions, and embracing renewables aren't just ethical choices—they're strategic imperatives for surviving escalating environmental crises.

The circular economy revolution transforms waste into wealth by keeping materials in perpetual use. Unlike traditional models where products meet premature graves, circular design emphasizes longevity, repairability, and recyclability. This paradigm shift requires unprecedented collaboration across entire supply chains—from miners extracting raw materials to consumers returning used products. When manufacturers, distributors, and buyers align around sustainability, we create self-sustaining systems that benefit both commerce and climate.

Building Value Loops, Not Just Chains

Modern enterprises are dismantling linear thinking, replacing straight-line production with infinite loops of value creation. These closed-loop systems treat every output as potential input, designing products for disassembly like puzzle pieces awaiting reassembly. The most progressive companies now view sustainability not as a cost center but as a profitability driver. They're proving environmental stewardship enhances brand equity while reducing long-term operational risks.

This transformation requires wholesale operational rewiring. Businesses must integrate ecological considerations into every decision—from supplier selection to customer engagement strategies. Pioneering firms are cultivating ecosystems of like-minded partners and developing financial instruments that make sustainability profitable. Green bonds, impact investments, and circular economy funds are fueling this quiet revolution in corporate finance.

The transition from linear chains to regenerative loops represents capitalism's most significant evolution since the Industrial Revolution. It demands perpetual innovation, cross-industry cooperation, and willingness to redefine success metrics. Companies embracing this shift aren't just future-proofing their operations—they're positioning themselves as leaders in the new economy where environmental and financial performance converge.

The Role of Innovation and Collaboration in Driving Circularity

Innovation in Circular Economy Models

Breakthrough innovations are dismantling barriers to circularity, yielding revolutionary materials like algae-based polymers and enzymatic recycling technologies. Visionary companies are re-engineering products for multiple lifecycles, embedding disassembly instructions in QR codes, and creating digital twins to track material flows. These advancements transform waste streams into revenue streams, proving environmentalism and economics aren't mutually exclusive.

Collaboration Across Value Chains

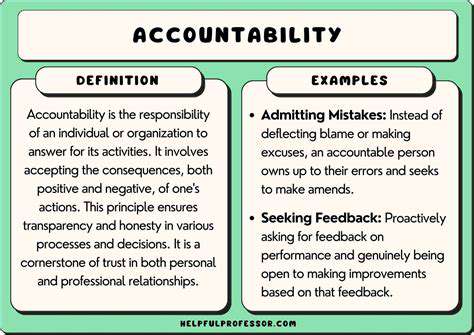

Circularity thrives on symbiotic relationships between traditionally siloed players. Manufacturers now co-design with recyclers, logistics firms optimize reverse supply chains, and retailers become product stewards. The most successful collaborations establish material passports—digital records enabling precise tracking of components across their entire lifespan. This transparency fosters accountability while creating new value extraction opportunities at every lifecycle stage.

Government Policies and Incentives for Circularity

Progressive legislation is accelerating the circular transition through carrot-and-stick approaches. Extended producer responsibility laws now make brands financially accountable for product end-of-life, while tax credits reward closed-loop innovation. Leading governments are implementing circular public procurement policies, using their massive purchasing power to drive market transformation. These policy frameworks create the certainty businesses need to justify long-term investments in circular infrastructure.

Consumer Engagement and Awareness

The circular revolution requires rewiring consumption habits through education and empowerment. Innovative brands are gamifying sustainability—offering repair tutorials, hosting swap events, and creating take-back programs with tangible rewards. When consumers understand their buying power as votes for planetary health, they increasingly choose brands aligning with their values. This cultural shift turns everyday purchases into acts of environmental stewardship.

The Role of Technology in Circularity

Artificial intelligence now optimizes material recovery rates, blockchain ensures provenance tracking, and IoT sensors enable predictive maintenance. Advanced sorting robots with hyperspectral imaging can identify and separate materials with 99% accuracy, dramatically improving recycling efficiency. These technologies create the visibility and precision needed to scale circular systems globally.

Measuring and Monitoring Circularity Progress

Leading organizations are developing multidimensional circularity scorecards tracking material health, renewable inputs, and system-level impacts. The most sophisticated metrics now account for avoided emissions and ecosystem services, capturing circularity's full value proposition. This data-driven approach helps companies optimize interventions and demonstrate tangible sustainability progress to stakeholders.

Financial Models for Circular Business Practices

Innovative financing mechanisms are emerging to de-risk circular transitions. Performance-based contracts tie financing to achieved sustainability metrics, while circular economy insurance products protect against material scarcity risks. Green venture capital funds specifically targeting circular startups have grown 600% in five years, signaling strong market confidence. These financial innovations prove sustainability can be both impactful and lucrative.